As we near the 2024 U.S. presidential election, many Americans are feeling uncertain about the future. Regardless of your political affiliation, you may worry about how your investments will perform under the next administration. Worries about the future are common during periods of uncertainty, but it is important keep those fears in check, especially when it comes to making investment decisions.

Following are four important facts you should know when investing in an election year.

#1 – The political affiliation of the elected president has little to no impact on investment returns.

While the political party in power can have a significant impact on many aspects of our everyday lives, most people are surprised to learn that the political affiliation of the elected president has historically had little to no impact on investment returns.

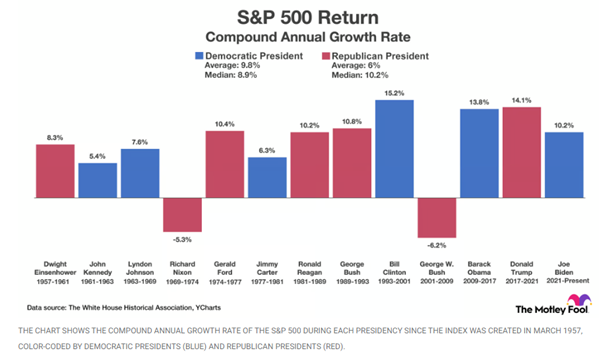

In the chart above, notice that under Democratic presidents, the S&P had an average annual return of 9.8%, versus 6% under Republican presidents. However, when we look at median performance, we see an 8.9% return under Democratic presidents and a 10.2% return under Republican presidents.

All this to say that market performance is largely unimpacted by the political affiliation of the sitting president. In fact, capital markets are impacted by one main factor: future earnings potential. Rather than worry about how the next president may impact your investment returns, you would be better off revisiting market fundamentals and reevaluating your portfolio with a focus on future earnings.

#2 – Markets tend to thrive when there is a division of power.

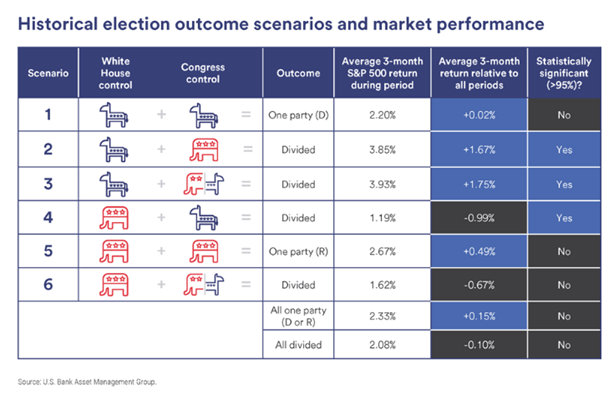

Although markets tend to be agnostic when it comes to politics, they are sensitive to policy, which has the potential to impact future earnings. Specifically, markets tend to be more volatile when there is a divided government, as illustrated in the table below.

Notice that when a single party controls both the White House and Congress, markets tend to have lower returns than when the government is divided. In fact, statistically significant positive returns occurred during periods when there was a Democratic president and a divided Congress. Also, the only statistically significant below-average returns occurred with a Republican president and a Democratic Congress.

Why does this occur? Because markets favor stability. When a single political party has the power to enact sweeping legislation with little resistance, the markets tend to respond with volatility. On the other hand, a divided government is slower to enact major changes, which means there is less uncertainty and less potential for major economic changes. This, in turn, leads to more continuity and predictability, which the markets tend to favor.

#3 – Uncertainty drives short-term volatility but rarely has a long-term impact.

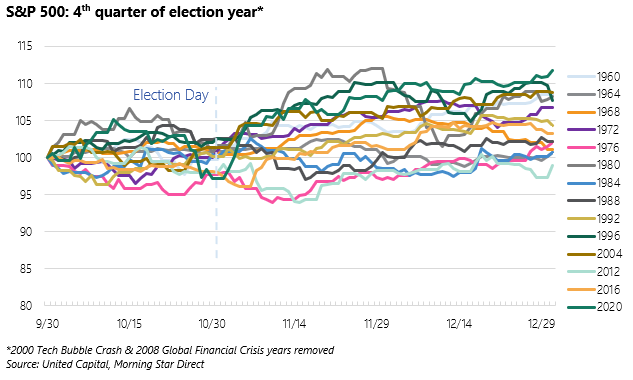

While political uncertainty can lead to volatility in the months before an election, that volatility tends to smooth out after the election outcome is settled.

Notice in the chart above that markets tend to trade in a narrow range during the months leading up to a presidential election. Following elections, that range widens. This pattern illustrates that the elimination of uncertainty in a presidential election year has more of an impact on market performance than the actual election outcome.

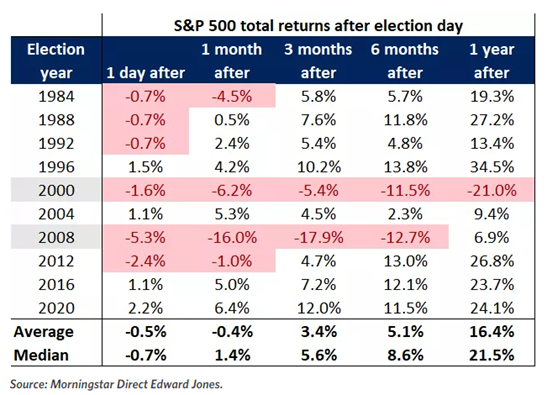

#4 – Markets tend to experience positive returns following an election.

It is worth restating that capital markets are driven by fundamentals, not politics. Over the past 40 years, the markets have achieved positive returns 12 months after a presidential election. The only exception to this pattern occurred in 2000 during the tech bubble burst. During all typical election cycles, market performance has dipped immediately following an election then gradually rebounded over the next year.

Key takeaways

So, what does all this mean for investors during an election year?

While presidential elections are important, and our elected leaders can have a significant impact on many aspects of our lives, the political party in the White House has less impact on our investment portfolios than many investors believe. One of the biggest investing mistakes you can make is to let fear and uncertainty impact your decision-making. Emotionally driven investment decisions have the potential to significantly derail your long-term progress.

Rather than making fear-based investment decisions, take the following steps to protect your investment portfolio during periods of uncertainty:

- Maintain a long-term investment approach. A great way to position your portfolio to weather market volatility is by establishing a diversified investment allocation in line with your long-term objectives, risk tolerance and time horizon. It is important that your investment portfolio be designed to work alongside your overall financial plan in order to help you achieve your goals across various market cycles.

- Stay invested. Making a decision to sell out of the market during periods of volatility can result in irreparable long-term damage to your portfolio. Not only do you risk locking in losses but you may also miss out on an eventual market rebound. A better approach is to position your portfolio for long-term success so that you can feel confident in your ability to weather market volatility.

- Work with a financial advisor. A great way to avoid making emotionally driven investment mistakes is to work with a qualified financial advisor. Your advisor can help you determine if you should make changes to your portfolio based on market conditions and your concerns. And if changes are necessary, he/she can help you execute them in a way that enhances your long-term financial situation, rather than harming it.

If you are looking for an advisor to guide your investment strategy and help you navigate market volatility, we would love to have a conversation. To learn more about how United Capital Financial Advisors can help you plan for the future, please contact us.