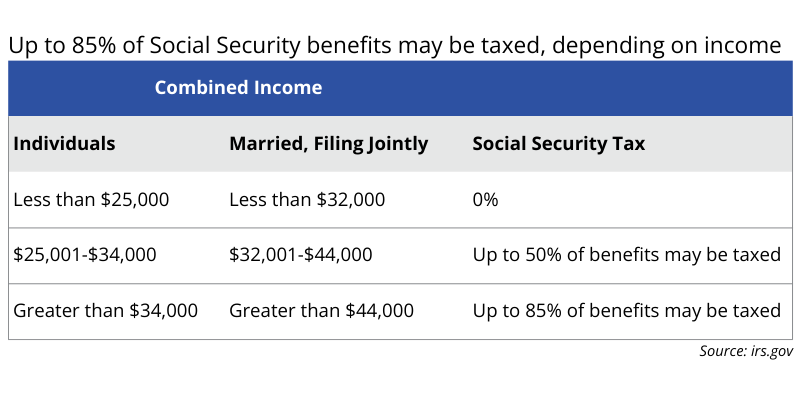

Many retirees are surprised to discover they can be taxed on their Social Security benefits. In 2024, if your combined income is more than $25,000 ($32,000 for married couples filing jointly), a percentage of your Social Security benefits will be subject to tax. The exact percentage rises alongside your income as noted in the table below.

The following tips can help you minimize the amount you owe in Social Security taxes.

#1 – Understand how combined income is calculated.

Social Security benefits are calculated based on your “combined income,” which makes this number an important one to understand. Combined income is calculated using the following formula:

Adjusted Gross Income (AGI) + Non-Taxable Interest + ½ of Social Security Benefit = Combined Income

- AGI is a measure of income that includes all taxable sources, such as employment wages, withdrawals from tax-deferred retirement accounts (including traditional IRAs and 401ks) and taxable investment income (such as interest and stock dividends).

- Non-taxable interest includes interest from municipal bonds and any other investments not subject to federal and (potentially) state taxes.

- 50% of your Social Security benefit is also included in the combined income calculation.

#2 – Complete a Roth conversion.

Beginning at age 73, retirees must begin taking required minimum distributions (RMDs) from any tax-deferred retirement accounts, including traditional IRAs and 401ks. These withdrawals are taxed as ordinary income and included in the AGI portion of your combined income calculation.

In contrast, Roth IRAs and Roth 401ks are funded with after-tax assets, which means withdrawals from these accounts are not taxable as long as you have reached age 59 ½ and have held the account for at least five years.

In certain circumstances, it may make sense to convert a portion of your traditional IRA or 401k assets to a Roth account, especially if you think you may fall into a higher tax bracket in retirement. This strategy involves selling assets from a tax-deferred account, paying taxes in the current year and moving those assets to a Roth account where they will continue growing for your retirement. You can then withdraw those assets in retirement without increasing your combined income and the associated Social Security tax liabilities.

Be aware, however, that a Roth conversion is a complex planning strategy that may lead to significant tax consequences. It is important to work with your wealth advisor to help ensure your Roth conversion is properly executed.

#3 – Consider a qualified charitable distribution (QCD).

Another way to reduce the tax impact of RMDs is by making a qualified charitable donation (QCD). A QCD is a direct transfer of assets from your pre-tax retirement account to a charitable organization. The assets transferred are excluded from your AGI, which can lower your combined income.

In 2024, the IRS allows individuals over age 70 ½ to donate up to $105,000 per year from a retirement account directly to a charity with no negative tax impact. The amount donated counts toward the annual RMD, but QCD assets are not added to your taxable income. This can be a great way to fulfill your charitable giving goals while also lowering your tax liabilities.

The key is to ensure payment is made directly to the charitable organization. QCD tax benefits will not apply if the payment is issued in your name. Also, be sure to maintain documentation of the transfer, as you will need to submit proper reporting when you file your annual tax return.

#4 – Delay your benefits.

If you have enough retirement savings to meet your income needs during the first few years of retirement, it may make sense to delay taking your Social Security benefits. By spending other sources of taxable income throughout your early retirement years, you may be able to lower your combined income enough to reduce the amount of Social Security benefits subject to taxes.

Plus, for each year you delay benefits (up to age 70), you can receive an 8% increase in payments, which can help minimize the amount you need to withdraw from other sources of retirement income once you start receiving benefits.

#5 – Take steps to manage your portfolio’s tax exposure.

Managing your investment portfolio in a tax-efficient manner can help reduce your taxable income and lower your tax exposure. One way to do so is by strategically dividing assets among taxable and tax-advantaged accounts, a strategy called asset location.

Asset location involves allocating tax-efficient investments to taxable accounts and tax-inefficient investments to tax-advantaged accounts. Because stocks receive favorable capital gains tax treatment, it is wise to hold these assets in taxable accounts or Roth IRAs. Investments with lower return potential and unfavorable tax treatment, such as U.S. government bonds and cash, should be placed in tax-advantaged accounts (such as traditional IRAs) to help lower their tax exposure.

If you could use some help minimizing your Social Security taxes, we would love to have a conversation. To learn more about how United Capital Financial Advisors can help you plan for the future, please contact us.