The 2017 Tax Cuts and Jobs Act (TCJA) is one of the largest tax-code overhauls our country has experienced in recent decades. However, many of the TCJA’s provisions are set to expire, or “sunset,” at the end of 2025, unless Congress takes action to extend them.

What does this mean for your tax planning strategy? Let us take a look at some notable provisions and how to prepare for their sunset.

#1 – Deductions

The TCJA made several sweeping changes to Americans’ eligible tax deductions.

- Income tax deductions –TheTCJA nearly doubled the allowable deduction to $12,000 for single filers and $24,000 for married couples filing jointly. This increase resulted in simplified filing for many taxpayers who no longer needed to itemize their deductions. In 2024, the inflation-adjusted deduction is $14,600 for single filers and $29,200 for married couples.

- Child tax credit –For families with dependents, the TCJA also replaced dependent exemptions with an increased child tax credit that doubled the maximum per-child amount. It also substantially increased the income threshold for benefit phaseouts, which made more higher-income families eligible for the child tax credit.

- Mortgage interest deduction –Prior to the TCJA, homeowners could deduct the mortgage interest associated with up to $1 million of debt used to purchase primary and secondary residences. They could also deduct interest associated with up to $100,000 in home equity debt. The TCJA limited the interest deduction to interest associated with up to $750,000 of mortgage debt and eliminated the deduction on interest associated with home equity debt.

- SALT – The TCJA capped the state and local tax (SALT) deduction at $10,000, which significantly impacted taxpayers in high-tax states.

In 2026, the deductions above are scheduled revert to pre-TCJA levels, adjusted for inflation.

Planning tips

An anticipated reduction in the allowable income tax deduction will likely mean that more people will need to file itemized tax returns. As a result, a wide range of potential deductions will likely return, which makes it important to maximize your deductions.

In preparation for the above tax law changes, it may make sense to consult with a tax professional who can help you identify ways to maximize your deductions and minimize your tax exposure.

#2 – Income taxes

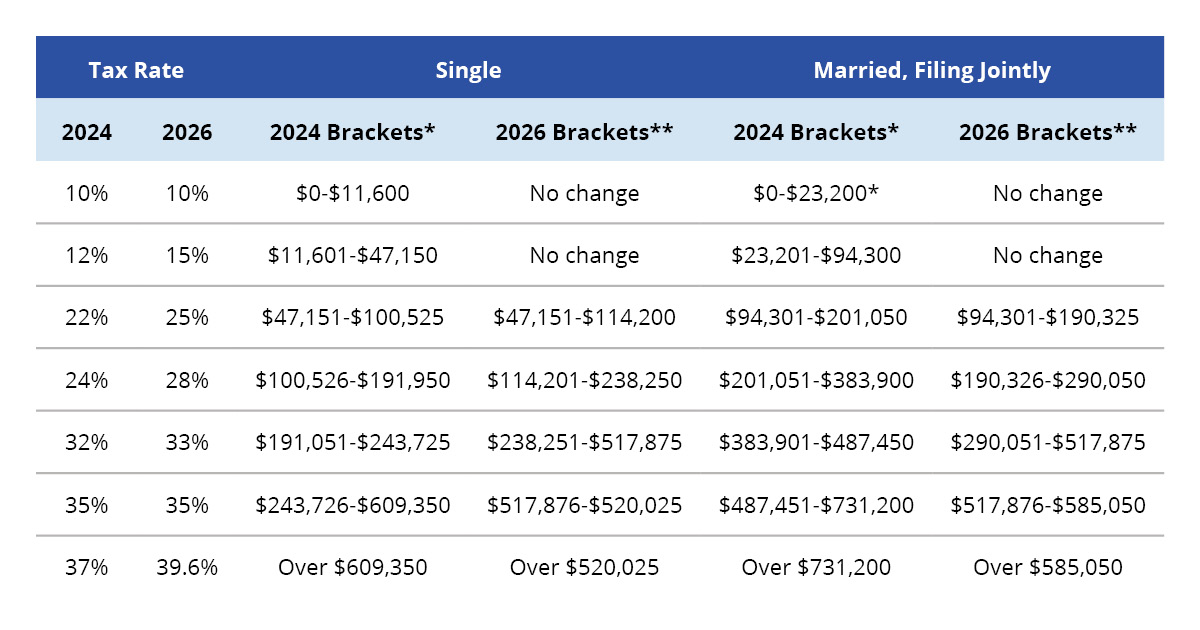

The TCJA lowered the federal income tax rate for most income levels. However, these lower tax brackets are set to sunset at the end of 2025 and be replaced with pre-TCJA higher income tax levels. The table below provides a breakdown of the potential federal tax increases.

*Indexed for inflation based on 26 U.S. Code § 1(f)(3)

**Estimated, indexed for inflation

Source: Creative Planning

Planning tips

Given the potential increase in income taxes, now may be a good time to consider a Roth conversion. This strategy involves converting pre-tax retirement assets held in a traditional IRA to after-tax Roth assets. Any assets converted are taxed at ordinary income tax rates during the year in which the conversion is completed. However, the benefit to this strategy is that withdrawals of Roth assets are exempt from federal income tax as long as the Roth account has been open for at least five years.

For example, let’s say a married couple’s annual household income is $250,000. In 2024, this puts them in the 24% tax bracket. However, if no action is taken by Congress, the couple will fall into the 28% tax bracket in 2026.

In 2024, the couple decides to initiate a Roth conversion of $133,900, which allows them to max out their current tax bracket. While they will need to pay taxes on the full conversion amount in 2024, they have the potential to save on taxes in the long run, once tax rates rise. And, by staying within the income range of their current tax bracket, they do not bump up to a higher rate in the current year.

#3 – Gift and estate tax

The sunsetting of the TCJA’s gift and estate tax provisions may have the biggest impact on older Americans. The TCJA raised the previous lifetime estate and gift tax exemption of $5 million (adjusted for inflation) to more than $11 million for individuals ($22 million for married couples filing jointly). The inflation-adjusted 2024 exemption has grown to $13.61 million for single filers ($27.22 for married couples filing jointly).

In 2026, the estate tax exemption is scheduled to revert to an estimated $7 million per individual ($14 million for married couples filing jointly). This means any amount exceeding the exemption may be subject to federal taxes as high as 40%.

Planning tips

Consider implementing the following tips today to help minimize your future estate tax exposure.

- Establish a spousal lifetime access trust (SLAT) –A SLAT is a type of irrevocable trust that can exclude assets from your estate while allowing a beneficiary spouse full access to the money. Establishing a SLAT can be an effective strategy for married couples who wish to lock in the current high exemption amount. Each spouse may want to establish a SLAT in his/her own name in order to preserve the current combined gift and estate tax exemption. For example, in 2024 you and your spouse could both transfer $13.61 into separate SLATs for the benefit of each other. By doing so, you can exclude the full $27.22 million from your taxable estate. Be aware, however, that this is a complex tax planning strategy. The “reciprocal trust doctrine” mandate states that if two spouses’ SLATs are too similar, the assets held within the trusts may not qualify for the estate tax exemption. It is important to work with a qualified financial advisor and an estate planning attorney to ensure this strategy is properly executed.

- Implement strategic giving strategies – Another way to minimize your estate tax liabilities is by gifting assets throughout your lifetime. This practice allows your assets to grow under your heirs’ ownership, which reduces your taxable estate. It also provides you with the joy of watching the positive impact of your gift on your family members’ lives. For example, say you wish to give $10 million to your heirs. If you make that gift in 2024, the entire $10 million would be free from federal income tax. However, if you wait until 2026, it’s likely $3 million (the amount that exceeds the projected $7 million exemption) will be subject to a 40% gift tax, which reduces your net gift to $8.8 million.

At United Capital, we take a proactive approach to helping clients minimize their tax exposure and plan for the future. If you could use some help with your tax planning strategy, we would love to help. Please contact us to learn more.