Holiday Rally to Finish 2023

By Frank Salb

Investing based on market adages is not a great strategy, but the “Santa Claus rally” delivered long-term investors a nice gift to end the year anyway. After a market pullback through late October, the S&P 500 Index rebounded nearly 16% during the final two months of the year and extended its annual gain to 26%.

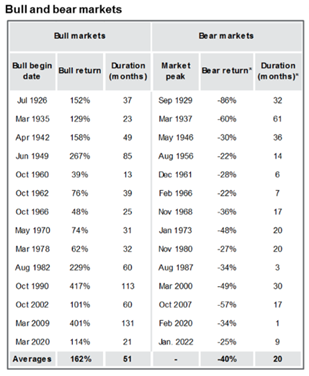

Source: Factset, NBER, Robert Shiller, Standard & Poor’s, J.P. Morgan Asset Management

Following a particularly difficult market environment in 2022, many investors’ expectations were set for a potential recession and continued losses in 2023. These predictions proved to be incorrect and are a strong reminder that predicting short-term movements in the markets can be a frustrating and mistake-ridden endeavor, because investing can be counterintuitive and inherently volatile. As an example, most prognosticators would have better results estimating the return of an investment over the following decade than they would over the following month or year. As a result, individuals can typically place themselves in the best position to succeed by having a long-term perspective and a disciplined plan.

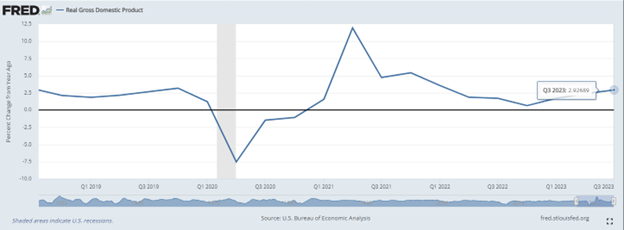

Source: US Bureau of Economic Analysis

Our economy experienced one of the greatest shocks in history as COVID-19 emerged, which in turn unleashed an economic tidal wave that has been moving through the economy over the last several years. Almost every measurable economic data point was impacted by this economic wave; most have followed a pattern similar to the real GDP chart shown above, albeit with different timing and magnitude of change. Most economic growth-related metrics dropped substantially in 2020 as people sheltered in place. In 2021, retail sales surged due to a reopening economy, pent up demand and excess liquidity from government stimulus. Spending outpaced the speed with which the economy could produce goods, so inflation increased rapidly through 2022. Finally, the last stage of this process was the Federal Reserve stepping in to fight inflation by dramatically increasing interest rates. Like any wave, the economy has been in a process of returning to a more normalized state, led by growth in 2022 and inflation in 2023, and most signs point toward a normalization of interest rates moving into 2024.

Source: Factset, NBER, Robert Shiller, Standard & Poor’s, J.P. Morgan Asset Management

Coming into 2023, investors had many things to worry about: The economy was decelerating as described by the wave above, we had the dreaded inverted yield curve due to the Fed pushing short-term rates higher and the stock market had already entered a bear market during 2022. As a result, Wall Street analysts collectively predicted poor market returns. Despite this, the S&P 500 delivered 26% throughout the year, leaving it just short of a new all-time high as we closed the year.

The stock market is extremely cyclical, and investors should expect that we will rotate between bull (rising) and bear (falling) markets on a fairly regular basis. Bear markets tend to occur once or twice per decade and are typically shorter and more dramatic, as fear sets in. Bull markets tend to last longer and climb slowly, as investors continually “climb a wall of worry.” The stock market has delivered strong returns over time, but bear market volatility is the price we pay as investors to achieve those strong long-term returns.

The last bull market ended on January 3, 2022, at a S&P 500 closing price of 4,797, and the current bear market hit its low point in October 2022. We finished 2023 at 4,769, just shy of a new all-time high, with the confirmation that the rebound of the last 15 months will be classified as a bull market. Either way, investors were rewarded for sticking to their long-term plan and allocation. The key takeaway from the chart above is that bear markets occur relatively frequently and are nearly impossible to predict; however, they can be successfully planned for, managed and survived. In fact, bear markets often offer some of the best investment opportunities.

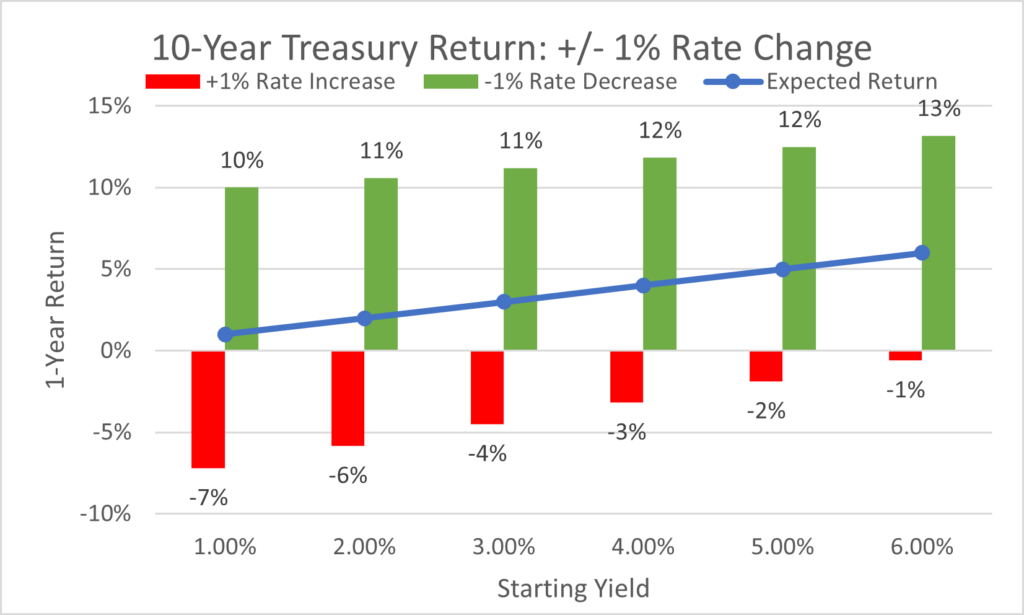

Source: Bloomberg, United Capital

The bond market (Bloomberg US Agg) delivered a rebound of its own in 2023 with a return of 5.53%. Historically, the bond market has produced a positive return in 43 of the last 48 years, but going into the fourth quarter of this year it was on pace to record its third consecutive annual decline. This left many investors asking, “is the bond market broken?” In reality, the bond market had been broken years ago when government bonds around the world traded at near zero, or in many cases actually had negative yields. This environment severely limited the return potential for bonds and greatly increased the likelihood of losses if/when interest rates increased again. 2022 was the perfect storm for the bond market that triggered those losses, but by doing so it helped to “fix” the bond market for investors looking forward.

As the chart above shows, the value of bonds has an inverse relationship with the direction of interest rate movements. It’s also important to note that the expected return of a high-quality bond is closely aligned with the yield that was purchased. Rising yields not only increase our expected return but also decrease our likelihood and/or magnitude of loss going forward. Investors would still be at risk of losing if interest rates went several percentage points higher, but most signs and the Fed’s guidance point to us being near the top of the interest rate cycle, with interest rate cuts expected by the Fed in 2024 and beyond. As mentioned before, some of the best investment opportunities present themselves during a bear market, and the prior two years witnessed one of the worst bond markets ever.

Mitigating the impact of a market downturn through proper liquidity and diversification should be an integral part of your financial and investment plan. While you may not be able to avoid short-term losses, liquidity and diversification give you the ability to wait for markets to recover. Falling markets also offer significant opportunities for investors to create value through disciplined rebalancing and tax-loss harvesting. The combination of a recovered stock market and attractive bond yields creates an opportune time, particularly for individuals in or nearing retirement, to reassess their risk tolerance and asset allocation. Reach out to your advisory team to begin the discussion.

—

Frank Salb is the Chief Investment Officer of United Capital. He has more than two decades of experience working in the investment industry, from individual financial planning to performing equity research at a large mutual fund company. He has led the investment department of a large institutional retirement plan consultant and served as the investment consultant to sophisticated C-suite retirement plan committees.

Frank received his Bachelor of Science degree in business administration (with a major in finance and a minor in economics) from Kansas State University. He also earned his Chartered Financial Analyst® designation from the CFA Institute.