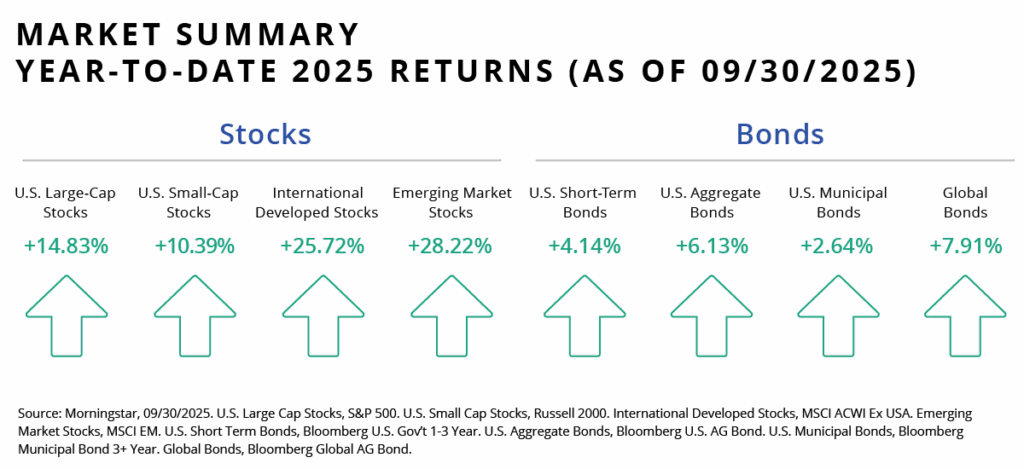

This image shows year-to-date 2025 returns as of 9/30/2025. U.S. large-cap stocks are up 14.83%. U.S. small cap stocks are up 10.39%. International developed stocks are up 25.72%. Emerging markets stocks are up 28.22%. U.S. short-term bonds are up 4.14%. U.S. aggregate bonds are up 6.13%. U.S. municipal bonds are up 2.64%. Global bonds are up 7.91%.

The spooky season is upon us and October has only just officially commenced! Markets are really no different. October is the home month to ominous monikered events such as Black Monday (1987) and Black Thursday (1929) that saw precipitous market declines. The key similarity is those who keep coming back, even among the frightening sights and screams, are justly rewarded; those who panic and flee are the ones who experience the real horror of disappointing long-term outcomes. Many of us can remember Black Monday in 1987 when markets fell a record 27% in one day! What is far less remembered is that markets actually ended positive that year after recovering from this seemingly monstrous decline.

Throughout the third quarter, markets continued their recovery from the spooks we experienced in April. While major elements of the stock market were down nearly 19% at one point, this really isn’t much of a departure from the standard volatility that visits markets on a regular basis. In any given year, the market usually experiences an average 14% decline at some point. It’s unpleasant for sure, but it’s a fact the prudent investor not only accepts but embraces.

Markets have justly rewarded the steadfast as always, but there have been some very positive, unique developments in 2025 worth highlighting.

Market breadth has expanded dramatically beyond the previously dominant tech titans, with segments such as international, small cap, domestic manufacturing and infrastructure showing strength.

The S&P 500 is now up 14.83% YTD, while international is up 25.72% YTD. This isn’t a byproduct of international developed markets all of a sudden getting their fiscal house in order (not happening), making necessary regulatory adjustments (a resounding not happening) or reversing a demographic trendline of decline far worse than the United States (likely to never happen).

In Europe, many countries are falling into the demographic quicksand (one-child households are the norm) that China’s been stuck in (China’s 1.2 billion population is set to be only 650 million by the year 2100, which is a massive contraction in a massively short time period). Interestingly, for the first time in United States history, more babies are being born to women over 40 than to women under 20.

Pivoting back from demographics to the markets, the point is that all these things happen for an entire host of intersecting and often random reasons. It’s great that international markets outperformed so dramatically during the recent volatility, but don’t go running to them now (as that would be just as inappropriate as having fled from them previously). Stay diversified, and stay focused on the long term.

Nobody knew the markets would recover so quickly (and I don’t mean 99% but rather an even 100%, as no one can foretell the future), but we’re happy they did. What the speedy recovery did reinforce is that you’re always rewarded more for being an owner versus being a lender over the long term. Use extreme caution taking advice from anyone who tells you otherwise. Best-case scenario, they’re essentially telling you they have clairvoyant powers; worst-case scenario (and, unfortunately, far more likely), they are peddling a commissioned product.

Nothing is guaranteed. Even Publishers Clearing House (for those old enough to remember Ed McMahon and those gigantic oversized checks making people instant millionaires) just declared bankruptcy. Under their new structure, they’ve agreed to only pay winners from July 15 of this year onward, leaving previous lifetime winners high and dry. There’s no such thing as a golden ticket. Do it right over and over and over again.

Moving on to so-called “boring old bonds,” let us not forget that we’re still in the midst of what’s effectively a five-year bear market for traditional public market fixed income. If we were in a five-year bear market for stocks, investors would be running around like their hair was on fire.

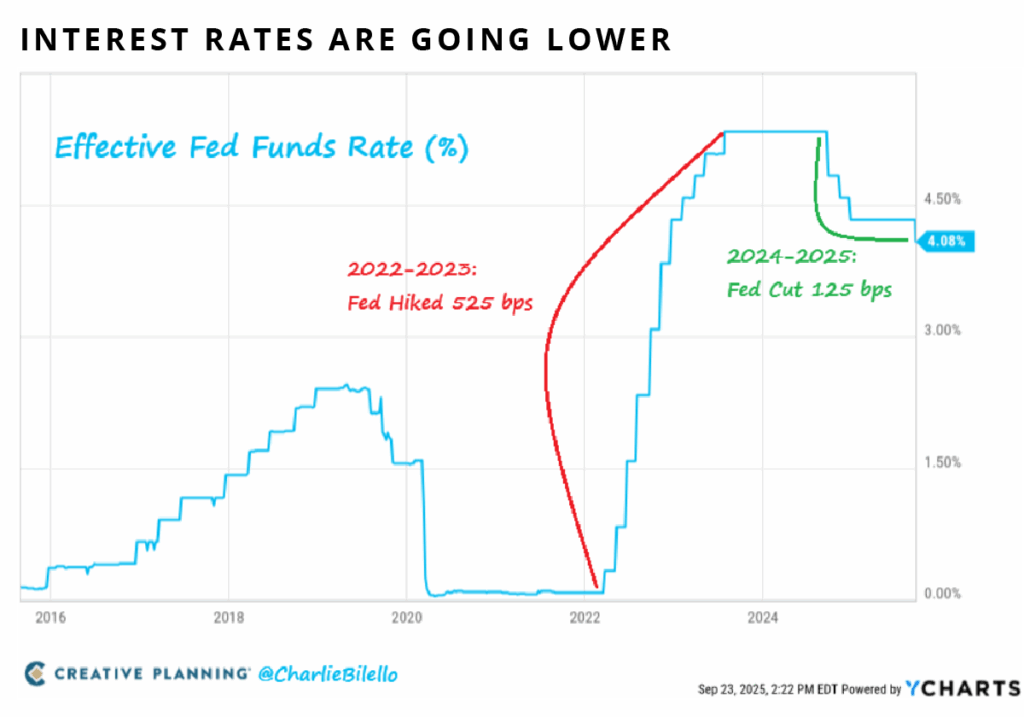

This period of weak performance was primarily driven by interest rates spiking higher to combat inflation. We’re now on the other side of this trendline, as interest rates have started to officially decline, with the Federal Reserve recently announcing another 0.25% reduction in rates. A good sign for all borrowers.

This chart demonstrates that interest rates have started going lower (beginning in 2024), showing how the Fed hiked interest rates 525 bps between 2022 and 2023 but cut interest rates by 125 bps between 2024 and 2025 thus far.

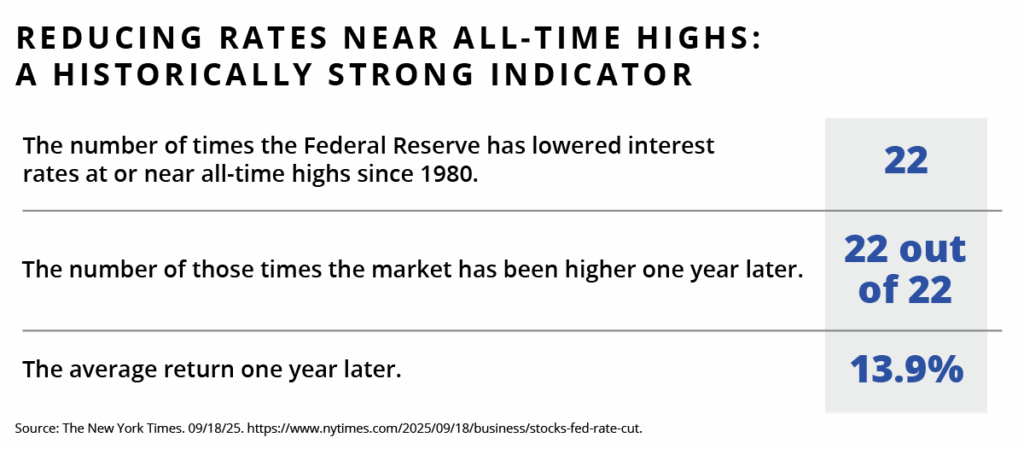

There’s one interesting, and uncommon, dynamic associated with this current round of interest rate reductions worth highlighting. Typically, rate reductions occur when something terrible is happening. Rates were cut in 2020 as COVID set in, in 2008 as the global financial crisis unfolded, in 2000 as the tech bubble burst — and in 1992 as my middle school girlfriend broke up with me! The point is that interest rates are typically declining as the stock market is declining in tandem. As graphed, the Federal Reserve has reduced interest rates 22 times since 1980 when at or near all-time highs (like what’s happening now), and in 100% of these occasions the market has been higher one year later with an above average return of nearly 14%. Could this time be different? Absolutely. But a historical pattern this consistent could largely be viewed as positive.

This table shows that reducing rates near all-time highs is a historically strong indicator, because the Federal Reserve has lowered interest rates at or near all-time highs 22 times since 1980, the number of those times the market has been higher one year later is 22 out of 22 times, and the average return one year later is 13.9%.

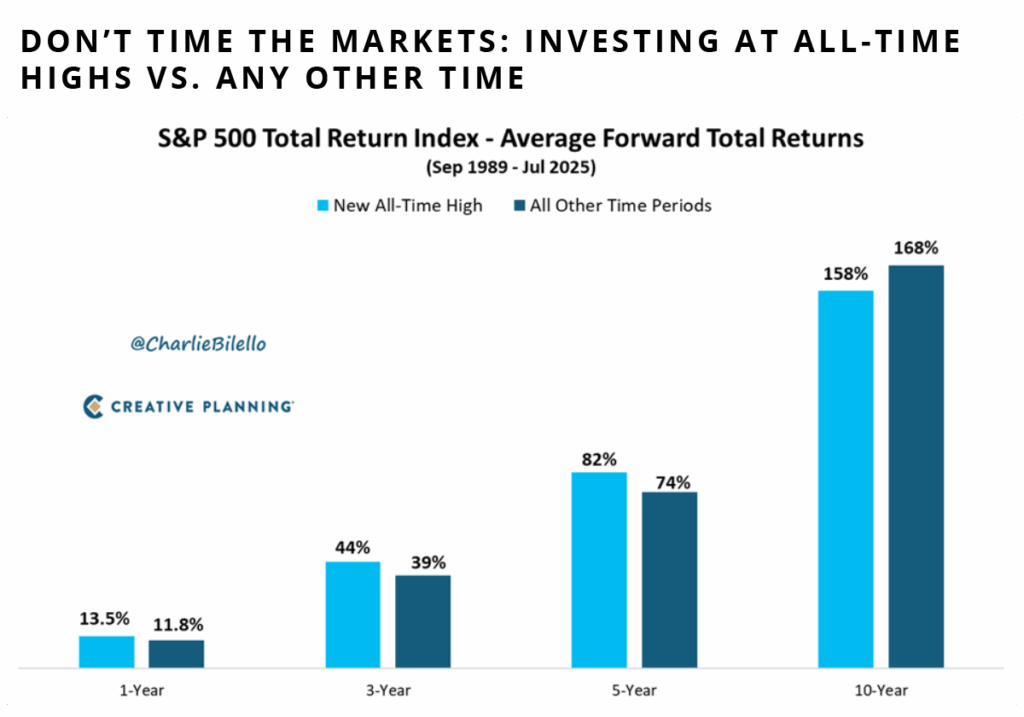

Some will say that while it’s great returns are higher one year later, investing at all-time highs is a bad policy — because markets will inevitably fall. To that, we’ll let the factual data tell these purveyors of doom that over the short- and mid-term, that’s incorrect, as investing only at all-time highs compared to any other time period actually produces higher returns. And over the longer term, the same behavior produces only slightly lower (although still extraordinarily high) returns. The point is this: stay invested, leave the timing attempts to tap dancers and focus on what you can control instead of worrying about what you can’t.

This chart depicts the historical outcomes of the S&P 500 Total Return Index when investing at only all-time highs versus investing at all other time periods (from September 1989 through July 2025). After one year, all-time-high investing is 1.7% higher than investing at all other time periods; at three years, all-time-high investing is 5% higher than investing at all other time periods; at five years, all-time-high investing is 8% higher than investing at all other time periods; and at ten years, all-time-high investing is 10% lower than investing at all other time periods.

As we end this note and barrel toward the end of 2025, here are a few often overlooked key considerations (it’s just like in “Cinderella” — when the clock strikes midnight on December 31, the opportunity is over):

- Don’t fail to accept guaranteed 100% returns for yourself or your loved ones. If you’re a part of a retirement plan, such as a 401(k) or 403(b), and you aren’t taking full advantage of a company match (companies often match contributions up to a certain percentage, such as if you contribute 3%, they’ll contribute 3% as well) then you’re effectively refusing a tax-advantaged raise. There’s still time to potentially modify payroll allocations if your budget allows. And even if you’re already retired and no longer a part of a retirement plan yourself, there are still potential benefits to be had. If you have a child, a grandchild or another special person in your life who may not be able to contribute enough to receive the full company match on their salary, you can gift them funds. Doing so allows them to maintain their same earnings (once factoring in the gift from you) while increasing the amount of their paycheck that’s contributed to their retirement plan. This then unlocks the matching dollars offered by their company, creating immediate tax advantages and allowing more investments to compound in growth over time. It’s a triple win!

- Set yourself up to maximize every potential lever you can, regardless of market conditions. In whatever way you’re investing, ask yourself if you’re putting it in the right bucket: should you invest in a Roth IRA, a traditional 401(k), a health savings account (widely viewed as the most tax-efficient account available), an education savings accounts for kids/grandkids, or some combination of these? How should you structure your taxable investment dollars (in a joint account, in a trust — and, if so, in which state, etc.)? These factors are totally within your control, and the long-term benefits of optimizing can be extraordinary.

- Don’t assume capital gains taxes are what they are. If you’ve had a capital gains event in 2025 (sold a concentrated stock, sold a business, sold a property, etc.), there’s still time to consider many strategies that may help minimize — or completely eliminate — these tax obligations.

This list is far from exhaustive, as everyone’s financial circumstances are different. We’re happy to discuss these further at any time, but it’s your particular needs and circumstances that need to drive actions. Don’t just guess at the short-term movements of markets or let fear (or, inversely, greed, which is just as evil), rather than fundamentals, drive your decision-making — that type of behavior is what’s really spooky.